Finance Secretary Benjamin Diokno briefed investors on the Philippines’ growth agenda during the Philippine Economic Briefing (PEB) held on the sidelines of the World Bank – International Monetary Fund (WB-IMF) Spring Meetings on April 12, 2023 (Eastern Daylight Time) at the Fairmont Washington, D.C., Georgetown.

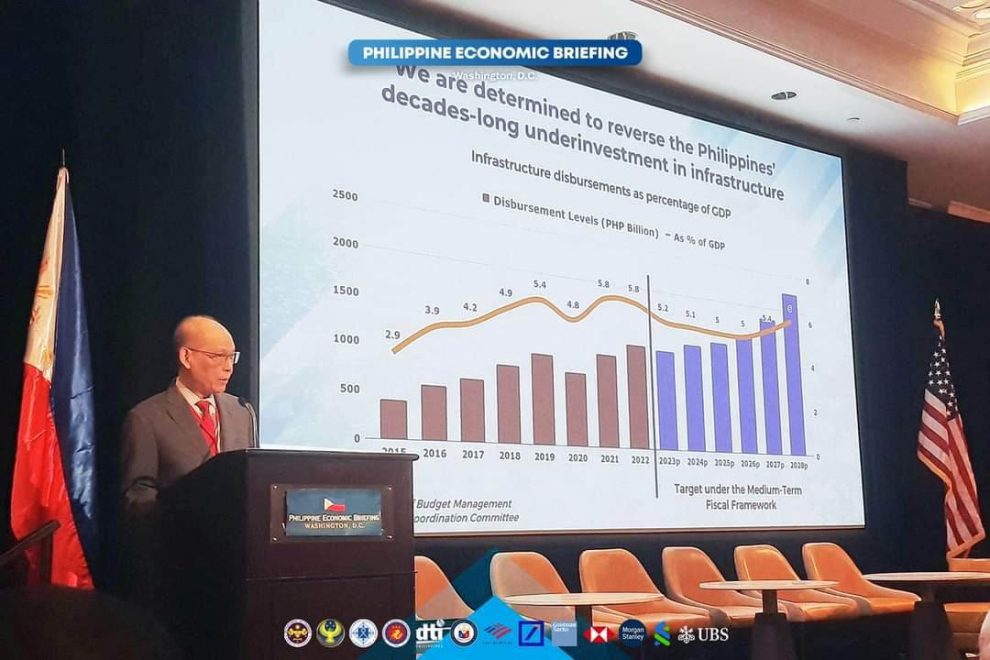

“Infrastructure spending is front and center of our growth strategy. We are committed to reverse the decades-long underinvestment in infrastructure: from 2001 to 2015, average infrastructure spending was only at 2 percent of GDP,” he said during his keynote speech.

The government is determined to sustain high infrastructure investment for the next six years through the public-private partnership (PPP) mechanism, which will enhance energy, logistics, transportation, telecommunications, and water infrastructure in the country.

“Now, the spectrum of industries that foreign investors can participate in has grown wider than ever before. The economic liberalization measures that the Philippine government has enacted in recent years have opened up key high-growth sectors to international participation,” Secretary Diokno said.

The amendments to the Retail Trade Liberalization Act (RTLA), Foreign Investments Act (FIA), and the Public Service Act (PSA) relaxed foreign restrictions on investments in the country.

Companies engaged in solar, wind, hydro, and tidal energy are also welcome to invest in the Philippines’ renewable energy (RE) sector now that it has been opened up to full foreign ownership.

The Philippines also offers a simpler and more effective fiscal incentives system that is performanced-based, time-bound, targeted, and transparent through the Corporate Recovery and Tax Incentives for Enterprises (CREATE) law.

From August 2021 to December 2022, total investment capital from approved priority activities with incentives under CREATE has already reached PHP414.3 billion This covers priority activities above PHP1 billion.

“We invite you to take a look at our Strategic Investment Priority Plan, which identifies priority industries, projects, and activities that can be granted fiscal incentives under the CREATE Act,” Secretary Diokno said.

The 2022 SIPP serves as the primary basis for determining priority industries, projects, and activities that can be granted fiscal incentives under the CREATE Act.

Categorized into three tiers, priority projects and activities listed under Tier III are directed towards emerging technologies that are consistent with the fourth industrial revolution, such as: artificial intelligence, nanotechnology, biotechnology, advanced digital production technologies, and innovation support facilities including space-related infrastructures. Moreover, these activities represent those that are qualified for longer income tax holidays.

“The Philippines’ impressive economic performance is the result of years of interconnected structural reforms,” Secretary Diokno said.

Ndiamé Diop (WB Country Director for the Philippines) agreed that opening up key sectors to investment is a significant move for the Philippines, saying, “It has been recognized that in the context of Philippines, the speed, the scale, and the impact of the infrastructure push would be limited if you don’t open up very key sectors, infrastructure sectors, to all investment, all type of investment including foreign direct investment. In fact, the investment regime of the Philippines has for a long time been one of the most restrictive in the region.”

The overall business outlook in the Philippines is more upbeat despite high inflation and external headwinds. The Bangko Sentral ng Pilipinas (BSP)’s recently released Business Expectations Survey (BES) revealed entrepreneurs to be optimistic towards a sustained positive outlook until the next quarter and over the next 12 months.

This improvement in business sentiment is supported by the surging manufacturing sector. Just recently, the S&P Global Purchasers’ Managers Index (PMI) reading for March 2023 was recorded at 52.5, marking the 19th consecutive month that the index has registered above the 50 index point threshold.

“Now, we are unfurling our sails to journey towards shared and sustainable economic prosperity, and your investments will be the wind driving this forward,” Secretary Diokno said.

Governor Felipe Medalla briefed investors on the Philippines’ outlook for 2023 until 2024. He reported that the BSP expects inflation to decelerate by mid-2023 before returning within target range by the end of the year.

Sanjaya Panth (Deputy Director for the Asia and Pacific Department of the IMF) commended the Central Bank’s policy stance, saying, “[W]hat has been very impressive for us about the Philippines is the speed with which the BSP acted in response to the rising pressures from inflation. With the speed and magnitude, it was in vanguard in the region. It delivered 425 basis points in rate hikes…and that has helped anchor inflation expectations going forward.”

Budget Secretary Amenah Pangandaman discussed the priority expenditures in support of the Philippine Development Plan (PDP) 2023-2028 for genuine economic and social transformation.

Socioeconomic Planning Secretary Arsenio Balisacan briefed investors on infrastructure development and investment in the Philippines.

Through the Medium-Term Infrastructure Program, the government will sustain infrastructure spending at 5 to 6 percent of gross domestic product (GDP) annually and program between US$20 billion to US$40 billion per year through 2028 for infrastructure.

Ndiamé Diop also noted the Bank’s analysis on productivity losses due to infrastructure backlogs.

“So therefore, by lifting the infrastructure spending to 5 percent, this is a game-changer,” he said.

The economic team engaged in a moderated discussion and Q&A alongside Michael Rodriguez (Managing Director at Macquarie Asset Management). Department of Information and Communications Technology (DICT) Secretary Ivan Uy also joined the economic managers to talk about ICT infrastructure development in the country.

The PEB in Washington, D.C. was jointly organized by the BSP’s Investor Relations Group and the Department of Finance (DOF), in partnership with the Department of Trade and Industry (DTI), Embassy of the Philippines in Washington, D.C., Bank of America Securities, Deutsche Bank, Goldman Sachs, HSBC, Morgan Stanley, Standard Chartered Bank, and UBS.

The event was attended by about 180 senior executives and representatives from large US-based businesses, industry associations, and financial communities.

“This is an exciting time to do business in the Philippines. The US and the Philippines have long enjoyed strong partnerships in trade and investment, and I look forward to expanding this even further with you in the years to come,” Secretary Diokno said in closing. (DOF)